Trending Useful Information on ascending triangle chart pattern You Should Know

Trending Useful Information on ascending triangle chart pattern You Should Know

Blog Article

Mastering Triangle Chart Patterns for Better Trading Techniques

Article:

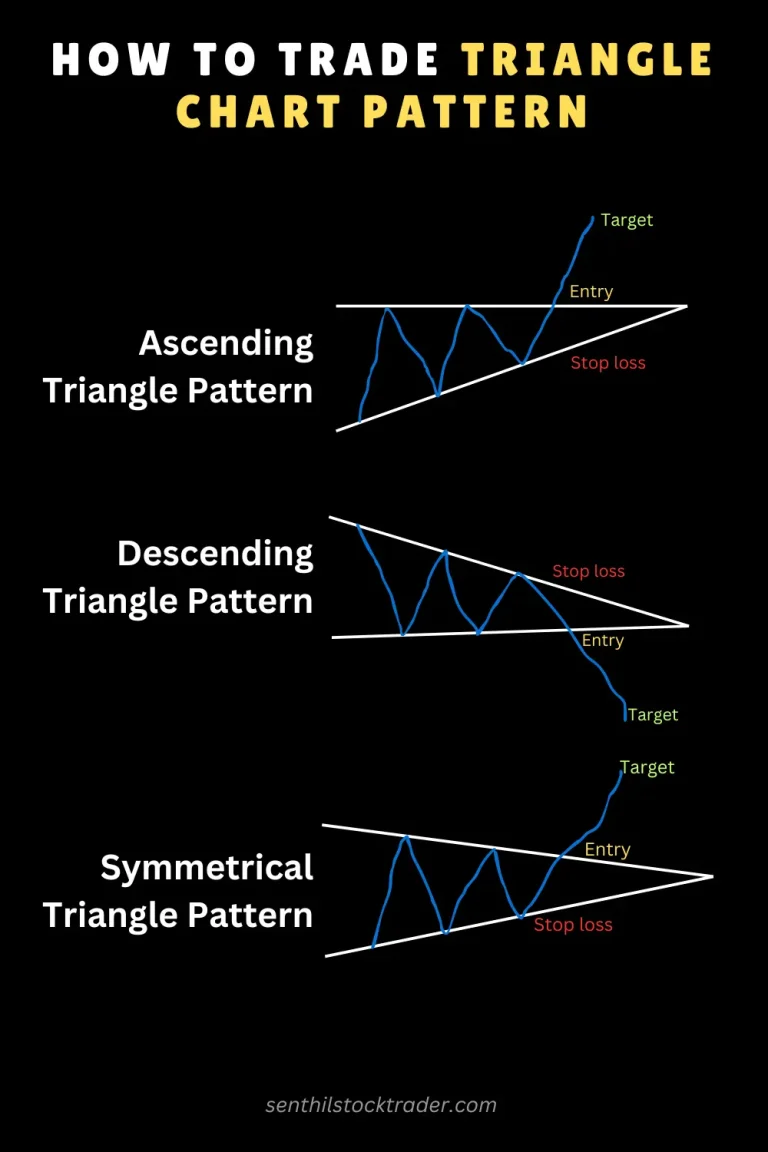

Triangle chart patterns are essential tools in technical analysis, supplying insights into market patterns and potential breakouts. Traders worldwide rely on these patterns to predict market movements, particularly during consolidation phases. One of the key reasons triangle chart patterns are so widely used is their capability to show both extension and turnaround of patterns. Comprehending the intricacies of these patterns can help traders make more informed decisions and optimize their trading strategies.

The triangle chart pattern is formed when the price of a stock or asset varies within converging trendlines, forming a shape resembling a triangle. There are various kinds of triangle patterns, each with special attributes, providing different insights into the potential future price motion. Amongst the most common types of triangle chart patterns are the symmetrical triangle chart pattern, the ascending triangle chart pattern, the descending triangle chart pattern, and the expanding triangle chart pattern. Traders also pay close attention to the breakout that takes place when the price moves beyond the triangle's boundaries.

Symmetrical Triangle Chart Pattern

The symmetrical triangle chart pattern is among the most often observed patterns in technical analysis. It occurs when the price of an asset moves into a series of higher lows and lower highs, with both trendlines assembling towards a point. The symmetrical triangle represents a period of consolidation, where the marketplace experiences indecision, and neither buyers nor sellers have the upper hand. This period of stability frequently precedes a breakout, which can happen in either direction, making it vital for traders to stay alert.

A symmetrical triangle chart pattern does not provide a clear sign of the breakout direction, indicating it can be either bullish or bearish. However, lots of traders use other technical indications, such as volume and momentum oscillators, to identify the likely direction of the breakout. A breakout in either direction signifies the end of the debt consolidation phase and the start of a new trend. When the breakout takes place, traders frequently anticipate considerable price motions, offering lucrative trading chances.

Ascending Triangle Chart Pattern

The ascending triangle chart pattern is a bullish formation, representing that buyers are gaining control of the market. This pattern takes place when the price produces a horizontal resistance level, while the lows move upward, developing an upward-sloping trendline. The key feature of an ascending triangle is that the resistance level stays consistent, but the increasing trendline recommends increasing buying pressure.

As the pattern establishes, traders anticipate a breakout above the resistance level, indicating the extension of a bullish trend. The ascending triangle chart pattern frequently appears in uptrends, enhancing the idea of market strength. Nevertheless, like all chart patterns, the breakout needs to be confirmed with volume, as a lack of volume throughout the breakout can show a false move. Traders also use this pattern to set target prices based upon the height of the triangle, including another dimension to its predictive power.

Descending Triangle Chart Pattern

In contrast to the ascending triangle, the descending triangle chart pattern is usually considered as a bearish signal. This formation occurs when the price produces a horizontal assistance level, while the highs move downward, forming a downward-sloping trendline. The descending triangle pattern indicates that selling pressure is increasing, while buyers battle to keep the assistance level.

The descending triangle is commonly found during drops, showing that the bearish momentum is most likely to continue. Traders often expect a breakdown below the support level, which can result in substantial price decreases. Similar to other triangle chart patterns, volume plays a critical role in confirming the breakout. A descending triangle breakout, combined with high volume, can indicate a strong continuation of the drop, offering important insights for traders seeking to short the marketplace.

Expanding Triangle Chart Pattern

The expanding triangle chart pattern, likewise called a widening development, varies from other triangle patterns because the trendlines diverge instead of assembling. This pattern takes place when the price experiences greater highs and lower lows, producing a shape that looks like an expanding triangle. Unlike the symmetrical, ascending, or descending triangle patterns, the expanding triangle pattern recommends increasing volatility in the market.

This pattern can be either bullish or bearish, depending on the direction of the breakout. However, the expanding triangle pattern is often viewed as an indication of unpredictability in the market, as both purchasers and sellers fight for control. expanding triangle chart pattern Traders who determine an expanding triangle may want to wait for a validated breakout before making any substantial trading choices, as the volatility connected with this pattern can result in unpredictable price movements.

Inverted Triangle Chart Pattern

The inverted triangle chart pattern, likewise called a reverse symmetrical triangle, is a variation of the symmetrical triangle. In this pattern, the price makes larger changes as time progresses, forming trendlines that diverge. The inverted triangle pattern typically shows increasing unpredictability in the market and can signal both bullish or bearish reversals, depending upon the breakout direction.

Comparable to the expanding triangle pattern, the inverted triangle suggests growing volatility. Traders need to utilize caution when trading this pattern, as the wide price swings can lead to unexpected and dramatic market motions. Validating the breakout direction is essential when interpreting this pattern, and traders typically depend on additional technical indications for additional confirmation.

Triangle Chart Pattern Breakout

The breakout is among the most essential elements of any triangle chart pattern. A breakout happens when the price moves decisively beyond the borders of the triangle, indicating completion of the combination phase. The direction of the breakout identifies whether the pattern is bullish or bearish. For instance, a breakout above the resistance level in an ascending triangle is a bullish signal, while a breakdown listed below the support level in a descending triangle is bearish.

Volume is an important factor in validating a breakout. High trading volume during the breakout shows strong market participation, increasing the probability that the breakout will result in a continual price movement. Alternatively, a breakout with low volume may be an incorrect signal, leading to a prospective turnaround. Traders ought to be prepared to act rapidly once a breakout is validated, as the price movement following the breakout can be fast and substantial.

Bearish Symmetrical Triangle Chart Pattern

Although symmetrical triangle patterns are neutral by nature, they can also offer bearish signals when the breakout occurs to the drawback. The bearish symmetrical triangle chart pattern takes place when the price consolidates within converging trendlines, however the subsequent breakout moves below the lower trendline. This signals that the sellers have actually gained control, and the price is most likely to continue its downward trajectory.

Traders can take advantage of this bearish breakout by short-selling or utilizing other strategies to benefit from falling prices. Similar to any triangle pattern, confirming the breakout with volume is necessary to prevent incorrect signals. The bearish symmetrical triangle chart pattern is particularly useful for traders seeking to recognize extension patterns in downtrends.

Conclusion

Triangle chart patterns play an important function in technical analysis, supplying traders with essential insights into market trends, consolidation phases, and prospective breakouts. Whether bullish or bearish, these patterns provide a reliable way to predict future price movements, making them essential for both newbie and experienced traders. Comprehending the various kinds of triangle patterns-- symmetrical, ascending, descending, expanding, and inverted-- makes it possible for traders to establish more reliable trading strategies and make informed choices.

The key to effectively making use of triangle chart patterns depends on acknowledging the breakout direction and validating it with volume. By mastering these patterns, traders can boost their capability to prepare for market motions and profit from successful chances in both fluctuating markets. Report this page